5 Personal Loans With Guaranteed Instant Approval

There is always a reason to require personal loans with guaranteed approval. Uncertainties surround us every time, which makes our day-to-day life more difficult. When these uncertainties get us, we move up and down, looking for money to help us out.

It could probably be in the middle of the month, and you do not expect any money sooner. All in all, the emergency needs to be administered, and that’s where personal payday loans come into play.

This article will unveil the five places where you can get personal loans with guaranteed instant approval. And I think this will be able to solve your emergencies. But first, let’s know more about instant personal loans.

What is an Instant Personal Loan?

When I talk of personal loans, I mean the kind of loans you can use for your benefits, not business. With personal loans, you can do whatever you want with them, and there is no restriction on what you should do with the money you get.

Some lenders approve Instant personal loans within a short while. And that will be good criteria to deal well with your emergency requirements.

You may require personal loans for requirements like a wedding, traveling, education, or house renovation.

Now, where you can get personal loans with guaranteed instant approval.

1. VivaPayday loans

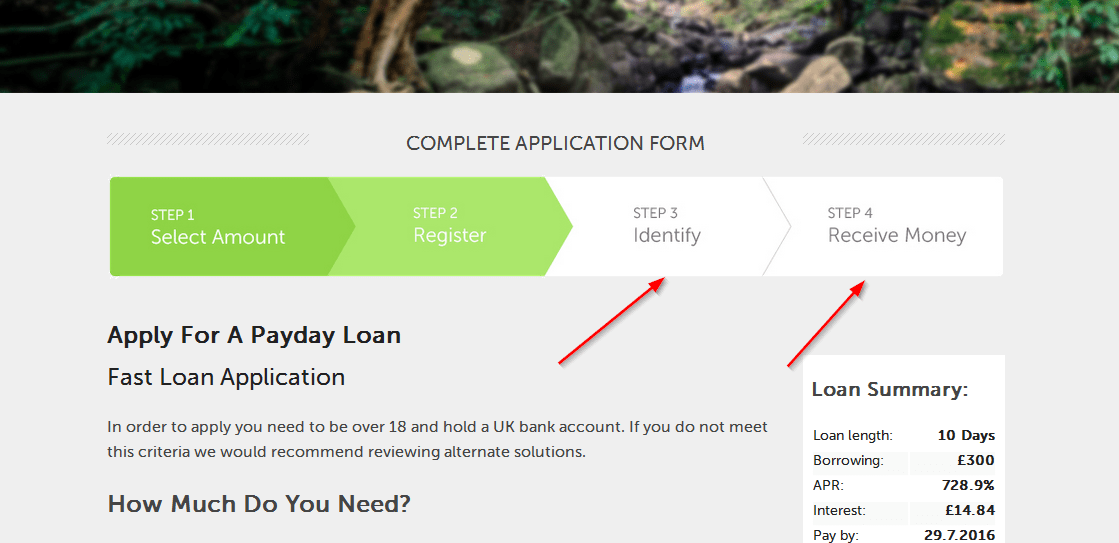

Vivapaydays is a platform that unites borrowers with lenders. It has a lot of lenders who can even accommodate those with bad credit scores. So if you have a very pressing emergency, then Vivapayday loans are the place to run because they can approve your loan within two minutes.

The good thing about Vivapaydays loans is that the process is entirely online, and you don’t need to keep dragging to and from offices. In addition, the online process is simple, reliable, and swift. It would be best to be confident with viva payday loans because there is instant approval of any personal loan you want.

In Vivapaydays, you can even apply for installment personal loans, which you will pay over a stretched period.

The eligibility criteria for Vivapayday loans

- You must have at least 18 years of age

- You should be receiving at least $1000monthly salary

- Have an active checking account

- Provide an actual address

- You should have valid identification documents

The average interest rate in Vivapayday loans is 5.99% to 35.99%, and you can repay from 2 to 24 months. The limits of Vivapayday loans range from $500 to $5,000.

2. MoneyMutual

MoneyMutual is yet another platform where you can get personal loans with guaranteed approval. You also conduct the application process online and still get approved quickly.

Money Mutual started back in 2010, and now it’s used by millions of clients to solve their financial emergencies. The agency has more than 60 lenders who are committed to helping borrowers meet their financial goals.

MoneyMutual, due to its broad range of lenders, can accommodate even those with bad credit history. In addition, the application process is fast and reliable, and you can get the funds within 24 hours, which is fair enough for sorting out emergency needs.

MoneyMutual does not charge the borrowers any fees while applying for personal installment or payday loans.

It has eligibility criteria common to that of Vivapayday loans.

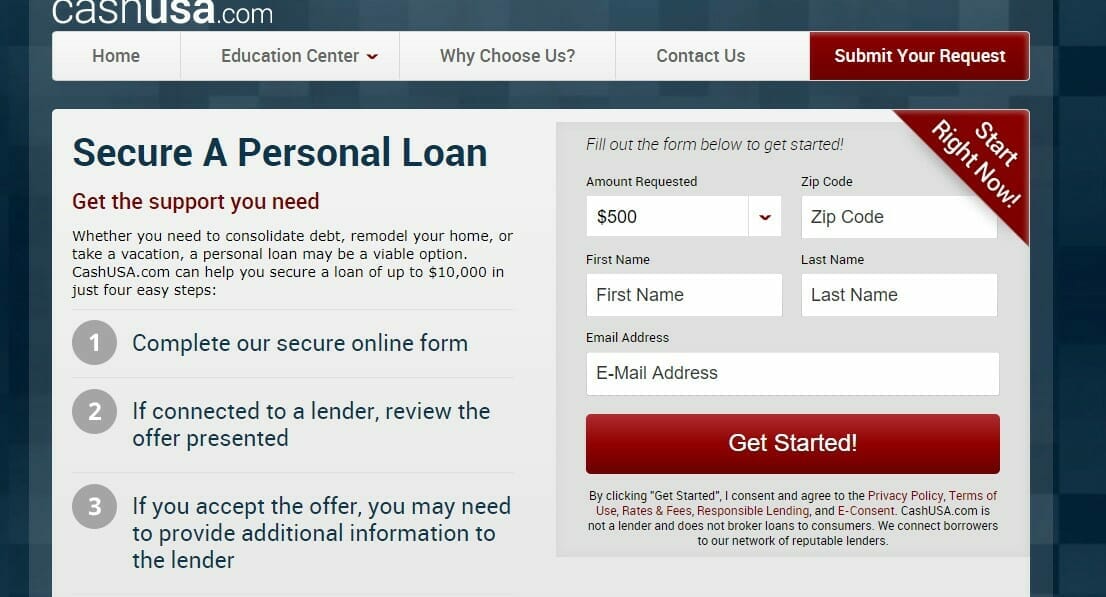

3. CashUSA

CashUSA is another platform where you can get personal loans with instant approval in the USA. CashUSA is a reputable and most reliable source of personal loans, payday loans, and installment loans to US citizens.

The borrowers do not pay any fees on the platform for them to get a loan. Instead, it links them with potential lenders who can quickly solve their financial crisis.

The maximum loan available in CashUSA is $10,000 from a minimum of $400.

4. PersonalLoans.com

Personal loans is another platform that you can get personal loans with guaranteed approval. Personal loans.com connects lenders with borrowers at the right time.

If there is no lender to offer you a loan, the platform can engage a third party to help you get a personal loan. The repayment period of personal loans in this platform can go up to 72 months. And these flexible payments are good for improving your credit score if you have a bad one.

5. Credit loan

Credi loan is yet another platform that can link borrowers with potential lenders. This company has been in operation since 1998, making it to be among the oldest online lenders. The lenders approve loans in 24 hours.

The highest limit on this platform can go up to $5,000. Hence it’s only convenient for those who need a small loan.

ALSO CHECK: What are Tribal Loans?

The bottom line

Getting a personal loan is simple, but you should always take precautions before you apply for any amount of loan.